Cost share is the portion of the total project costs that are paid by an entity other than the sponsor. Although the majority of cost share at MSU is a commitment of university funds, it may also be a commitment from a third party. Cost sharing can be in the form of actual cash or commitment of effort from personnel. It can also be direct or indirect costs of the project.

There are three types of cost share: mandatory, voluntary committed, and voluntary uncommitted.

- Mandatory cost share is the university’s portion of contribution to the project that is required by the sponsor. It must be included in the proposal to be considered by the sponsor. Mandatory cost share is required to be tracked and reported to the sponsor by post award (CGA).

- Voluntary committed cost share are quantifiable resources committed and budgeted for in a proposal. This is not required by the sponsor as a condition of receiving the award. Once offered in the proposal, this contribution becomes a binding commitment to the University upon award.

- Voluntary uncommitted cost share is faculty effort and other direct costs that are over and above what is committed and budgeted for, but is not legally obligated. This type of cost share does not have to be documented, tracked, or reported as it is not required by the sponsor, and it should not be listed in the proposal. Voluntary uncommitted cost share is most frequently the result of reported effort in excess of commitments on a completed effort report.

The type of cost share that is included in the proposal determines the documentation needed at proposal stage. With mandatory cost share, OSP Proposal Teams will need to see the cost share portion when reviewing the budget. The mandatory cost share amount must be listed on the eTransmittal in the “Total Cost Sharing/Matching/In-Kind Included” field under "Other Financials".

If you include voluntary committed cost share, the OSP Proposal Teams are likely to suggest omitting the quantifiable resources from the proposal. The University only wants to include cost sharing on a proposed budget, narrative, or budget justification when absolutely necessary. If quantifiable costs are pertinent to the project, OSP may request a budget to show calculation of costs. On the eTransmittal, a "Note" needs to be included describing the voluntary committed cost share on the project. Please remember that salary amounts in excess of the NIH salary cap are considered voluntary committed cost sharing, as well as the associated fringe benefits and indirect costs. Some federal agencies, like the National Science Foundation (NSF), have a specific policy that prohibits voluntary committed cost share.

The most common types of cost share and easiest to document are effort from MSU personnel and unrecovered facilities and administrative (F&A) costs. Effort is tracked using the effort reporting system on the CGA website. Effort reports act as a “receipt” for effort/time spent working on a sponsored project and meet the federal requirements for documentation for such cost share. Unrecovered F&A is the difference between total F&A costs if the University’s full F&A rate is applied to applicable direct expenses and the allocated F&A costs using the rate approved in the award.

Example – Current F&A rate 53.5%, Agency approved rate 20%, $10,000 applicable direct costs

- F&A costs at 53.5% = $5,350

- F&A costs at allowed 20% = $2,000

- Difference of $3,350 is unrecovered F&A and can be reported if unrecovered F&A was approved as allowable cost share in the agreement

Other types of cost share expenses can include non-personnel direct costs, such as supplies and services, as well as in-kind matching from a third party. Documenting these types of costs can be very time consuming, and require PI and department record-keeping for documentation.

How cost share is reported depends on the type of cost share. Required cost share is monitored and reported by CGA as invoices or financial reports are submitted.

Effort

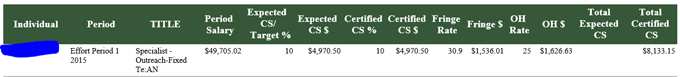

The amount to be reported from certified effort is determined using the Effort Report Summary which pulls data directly from effort reports and payroll. The following is a screen shot of the data provided from the report.

Other Allowable Expenses

If expenses other than effort are budgeted as cost share, CGA requires that the department send operating statements (FIN049) with the cost share expenses highlighted. The operating statements must also include a certification from the PI that the expenses were incurred for the project. CGA requests that these certified operating statements be sent quarterly to the Cash Management or Reports Group. If not received by CGA, a request for the operating statement(s) will be sent when the financial report is in process.

Unrecovered F&A

If budgeted and part of the award, unrecovered F&A is calculated and reported by CGA each time a financial report is submitted.

In-Kind Third Party

In-kind third party matching requires a certified letter from the third party describing the matching expenses incurred.

There are many resources available that provide information about your award. However, it can often be very confusing to know where to go for information, or several tools are needed to obtain the information you seek. Account Explorer (AE) is a tool developed by Contract and Grant Administration (CGA) to help manage your restricted awards (RC accounts) by providing relevant information in one location.

Many people use AE to determine whether prior approval from their grantor is needed before a particular action or purchase can occur. Prior approval checkboxes are now being added to RC accounts to easily display the most common reasons MSU may need to receive such approvals, based on the specific award conditions. The prior approval checkbox enhancement provides a much faster alternative to assessing information than reading the text notes that are also listed in AE. As seen in the below example, if a checkbox is marked, the department should contact CGA's Awards Group to request the prior approval.

You can pull up your project information by entering your RC account number in the Search Box at the top of AE. If you don't know the account number, you may be able to find the project information by using other search criteria, such as APP number or PI name.

When the account loads into AE, key project information, including award amount, spendable balance, project dates, grantor, and PI, is listed towards the top of the page. In addition, several tabs of information, some of which are highlighted below, are available to help you manage your project account.

This is the default information that is displayed when your project account loads in AE. Located under the previously discussed prior approval checkboxes, several notes will be listed specifically related to your award, including compliance notes (IRB, IACUC, or COI) and Account Notes. These notes will include all award actions, such as modifications, terms and conditions, and department responsibilities, in addition to other information.

This is the default information that is displayed when your project account loads in AE. Located under the previously discussed prior approval checkboxes, several notes will be listed specifically related to your award, including compliance notes (IRB, IACUC, or COI) and Account Notes. These notes will include all award actions, such as modifications, terms and conditions, and department responsibilities, in addition to other information.

This tab is currently the only place where you can get all subaward information related to your account, for proper subaward management. The main screen in this section will provide basic information such as subaward amount and unpaid balance by object code for each subrecipient. By selecting a specific subaward, you can access more detailed information, including payments, advances and reconciliations, reported cost share, A-133 expiration date and risk level.

This tab is currently the only place where you can get all subaward information related to your account, for proper subaward management. The main screen in this section will provide basic information such as subaward amount and unpaid balance by object code for each subrecipient. By selecting a specific subaward, you can access more detailed information, including payments, advances and reconciliations, reported cost share, A-133 expiration date and risk level.

CGA either submits an invoice for payment or draws funds from a federal letter of credit system, depending on the award conditions. When CGA submits invoices or receives funds, information is recorded in the Billing tab. In this section, clicking on "show KFS deposits" will display the KFS document numbers for each payment received by the grantor. If the payment was against an invoice, the invoice will be attached to the KFS document. This may help you assess how quickly the grantor is paying for project expenses, identify a collection issue, and determine a cash position.

CGA either submits an invoice for payment or draws funds from a federal letter of credit system, depending on the award conditions. When CGA submits invoices or receives funds, information is recorded in the Billing tab. In this section, clicking on "show KFS deposits" will display the KFS document numbers for each payment received by the grantor. If the payment was against an invoice, the invoice will be attached to the KFS document. This may help you assess how quickly the grantor is paying for project expenses, identify a collection issue, and determine a cash position.

You can see who was paid on your account without using SAP or Business Intelligence via AE’s Payroll Tab. The dates are customizable, and all individuals paid on the account will be listed, in addition to the object code, amount paid and either the percentage of their salary or the number of hours paid by the account.

You can see who was paid on your account without using SAP or Business Intelligence via AE’s Payroll Tab. The dates are customizable, and all individuals paid on the account will be listed, in addition to the object code, amount paid and either the percentage of their salary or the number of hours paid by the account.

Additional Assistance

Account Explorer, as well as CGA's website in general, offers much more information than what was highlighted in this article to assist with your RC project account management. If you would like additional training for yourself or your unit, or have specific questions related to the resources available on our website, please contact Kristy Smith or Evonne Pedawi.