Effective January 2015, Affordable Care Act (ACA) fees will be charged to department accounts for eligible employees as determined by HR. Although the fee will be allowable on RC accounts, an RC account cannot be used as the default ACA fee account provided to HR by a department. For questions regarding the fee, eligibility of employees, or what department account will be charged, please contact HR at hr.ACAHealthFeeInfo@hr.msu.edu or visit hr.msu.edu/aca/.

ACA fees are charged by Human Resources via a service billing in the following month. For example, ACA fees for September typically will be processed through KFS during the month of October. You can verify the month that was charged by reviewing the description or explanation on the service billing. Once charged to the department, the ACA fee can be allocated to the appropriate account(s), including RC accounts, using a Distribution of Income and Expense (DI) in KFS. To be consistent with MSU procedures, if the fee is being reallocated, it must be divided evenly amongst the accounts on which the staff member was paid for during the month and not be allocated based on effort/number of hours worked on each account. (Please note, if reallocating to an RC account after 90 days, a General Error Correction (GEC) must be used, and if the account is a federal/state account, a cost transfer form must be completed as this will be considered a late cost transfer.) The instructions/examples below will assist in the timely processing of the reallocations.

- Determine the accounts to which the fee should be allocated by running the BI report HRP062 titled Labor Distribution by Person. Run the report using the date range for the month of the ACA fee. For example, if the ACA fee service billing references that it is for September, the HRP062 report should be run using a from date of 9/1 and a to date of 9/30.

- Create a PDF of the HRP062 report that you run for each individual.

- Initiate a DI (or GEC for charges over 90 days old) in the KFS system after the ACA Fee is charged to the department/default account.

- The description should read "Distribute ACA Fee".

- The explanation should read "Distribute the (MONTH, YEAR) ACA Fee to (ACCOUNT/S) for (EMPLOYEE NAME)" (see example below). The accounts listed should represent the number of projects the individual was paid on throughout the month as indicated under the earnings summary on the labor distribution report by person (HRP062) report.

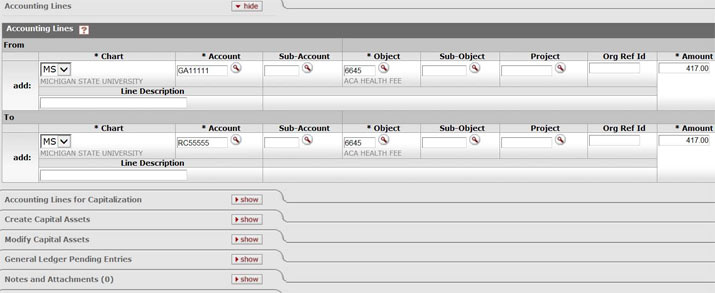

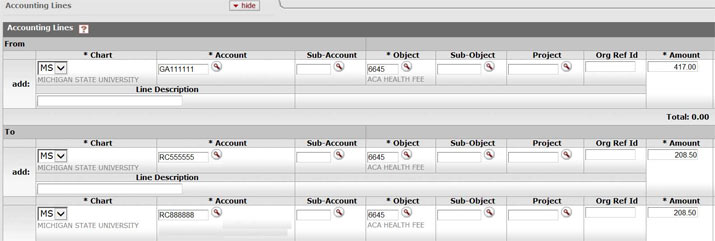

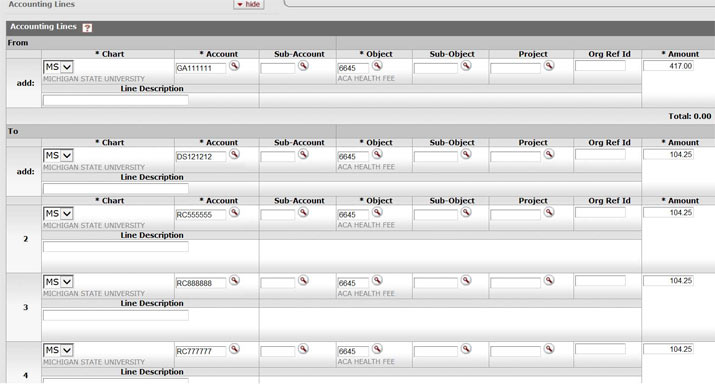

- The "From" and "To" sections should show the following (see below for example):

- The "From" accounting line should reflect the department account the ACA fee was billed to on the service billing, object code 6645, and the total amount billed.

- The "To" accounting line should reflect the account(s) that the employee was paid on during that month as reflected in the earnings total on the HRP062 report, object code 6645, and the amount to allocate. Please remember to equally distribute the total amount of the fee between all accounts that were charged salary.

- Attach the PDF of the HRP062 report that you created and the operating statement (FIN049) showing the ACA fee that was charged (or reference the KFS document number for the ACA fee service billing) for documentation. If the expense is over 90 days old and being transferred to a federal/state grant account, also attach the cost transfer form.

FAQs

Q: What if the employee worked on two RC accounts for the month of January?

A: The total amount must be evenly allocated between the two accounts.

Q: What if the employee worked on three RC accounts and one unrestricted account for the month of January?

A: The total amount must be evenly allocated between the four accounts.

Q: What if the employee only worked one hour on RC55555 and the rest of their time on RC11111 for the month of January?

A: The total amount must be evenly allocated between the two RC accounts and not based off of the number of hours worked.

Q:What if the employee did not work any hours for the month of January?

A: Run report HRP062 for the month the employee most recently worked prior to January. Allocate the ACA fee based on the accounts that the staff member was paid for during the month the individual most recently worked.

For additional information and questions regarding charging the ACA fee to RC accounts, please contact Contract and Grant Administration, Audit and Compliance Group at audit.compliance@cga.msu.edu.